Gov. Walker touts proposed homestead tax credit he says will keep seniors in their homes

WEST ALLIS -- Governor Scott Walker says the homestead tax credit would keep seniors in their homes, and it's a proposal he's touting on the campaign trail as he seeks re-election to a third term.

Governor Walker on Monday, Oct. 1 invited the media to Carol Kimpel's home in West Allis.

"I've been in here since it was built," said Kimpel.

Carol Kimpel and Governor Scott Walker

That was back in 1953. Governor Walker said his proposal will make it easy for seniors like Kimpel to afford and stay in their homes.

"If I'm elected, in our next state budget, we will put a 50 percent increase in the homestead tax credit," said Governor Walker.

The plan would increase the maximum income eligibility and the maximum amount of the homestead tax credit.

"The idea with the homestead tax credit is to try and offset, for seniors who may not have the means because of fixed incomes, to pay for property taxes," said Walker.

Tony Evers

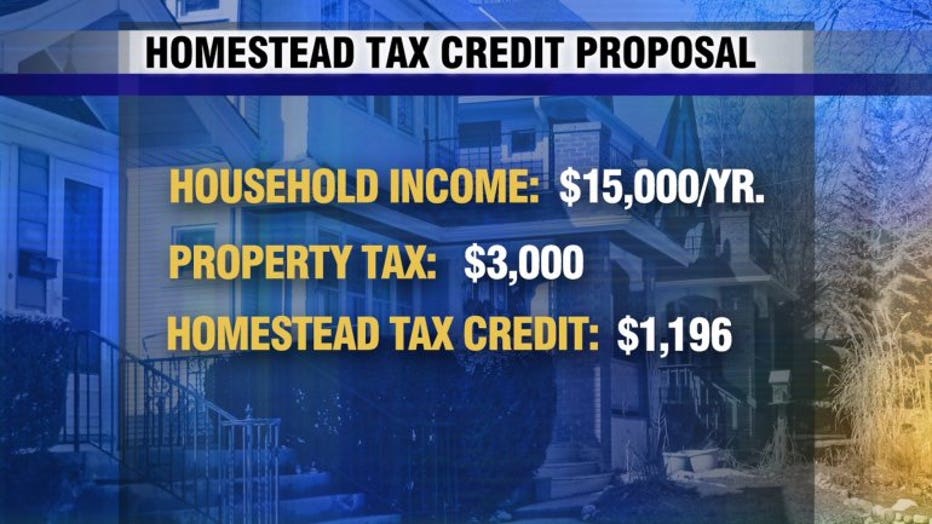

Governor Walker offered this example: A senior with a household income of $15,000 a year and a property tax bill of $3,000 would see a homestead tax credit of $1,196 -- an increase of $867.

"We think that's a stark contrast to our opposition, Tony Evers, whose plans in the past have talked about raising property taxes," said Governor Walker.

FOX6 News caught up with Evers Sunday at the opening of the Democratic campaign office in Milwaukee.

"Think about transportation and Scott Walker's claims that he hasn't raised taxes. Well, what in the heck are the wheel taxes? Twenty municipalities are taxing people now for roads because Scott Walker didn't do his job. That is a Scott Walker tax -- period," said Evers.

The election is Nov. 6.