'It has a big impact on your credit score:' Avoid debt and common credit card mistakes

MILWAUKEE -- Credit card debt is at an all-time high. Americans paid $100 billion in credit card interest and fees in 2018. The average credit card balance is $6,348 -- with 71 percent not being paid off each month.

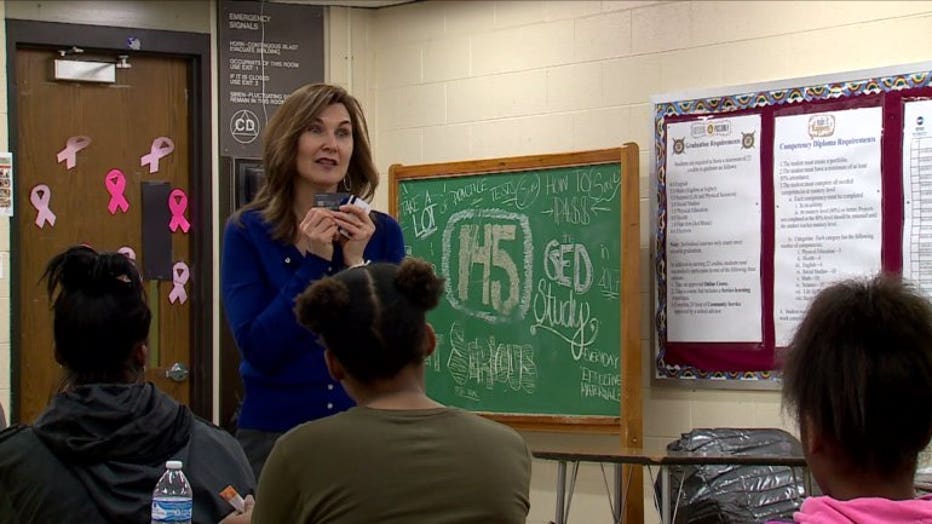

At Vincent High School, Brenda Campbell of SecureFutures taught about credit card accountability. It's was a lesson in the basics that many adults may want to sit in on.

"How to make choices about needs versus wants. How to responsibly manage that without paying interest," Campbell said about what was being taught in the class.

With the Federal Reserve expected to keep raising rates, people will be paying even more to carry debt.

Brad Allen of Drakes and Associates said it can take years to pay off a credit card if you only make a minimum payment. Allen called it a "big mistake." Another mistake many people make is missing payments.

Brenda Allen, SecureFutures, leads a lecture at Vincent High School.

"After 30 days or 60 days, they start reporting that to the credit bureaus. It has a big impact on your credit score," Allen said.

In addition, avoid taking out cash advances, which have fees and higher interest rates. Don't run a high balance. In fact, you should only use 30 percent of your available credit to not affect your credit score.

Another tip, avoid opening too many accounts. Credit bureaus view those as an opportunity to accumulate more debt.

Brad Allen, Drakes and Associates

"They say two to five cards is usually the range you want to be in," Allen advised.

Meanwhile, Campbell armed young adults with knowledge, so they won't wind up paying for early mistakes.

"We hope they will not carry a balance over from month to month, that they'll be looking for a credit card with a lower interest rate," Campbell said.

Baby boomers carry an average balance of more than $8,000.

If you have debt across multiple cards, pay the minimum balance on all but the smallest. Throw as much at it as you can until the card is paid off and then move to the next lowest card.