'Very frustrating:' Stimulus checks give financial relief to many, but some are still waiting

MILWAUKEE -- Federal stimulus checks are giving financial relief to many while some are still waiting.

Robin Tzebny and her sons are counting on that stimulus check.

"It's very frustrating you know, because I'm a mom of two," Tsebny said. "Being home all day with them and that little bit of money, not working, would help a lot."

Tsebny filed taxes with H&R Block which told FOX6 News the IRS has "created confusion by not always using clients' final destination account information for stimulus payments."

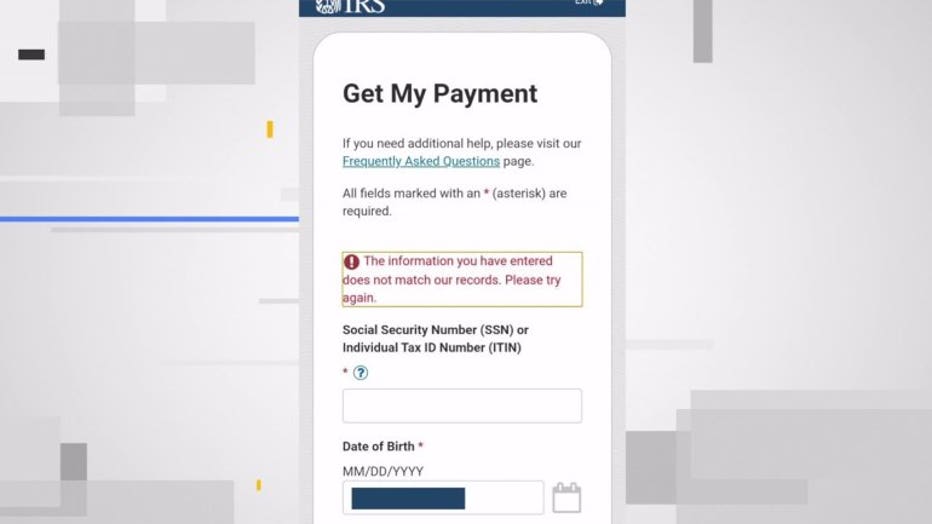

Tsebny tried using the IRS' "Get My Payment" tool to enter her bank account details. But she was told, "The information you have entered does not match our records."

"I'm really worried I won't be getting a check because of the mixup," Tsebny said.

Brian Sprague is having the same problem. He filed his taxes himself -- and said the IRS has successfully taken his auto payments before.

"The lack of knowledge about what's going on, that's the most frustrating part," Sprague said.

The IRS is referring people to its frequently asked questions on IRS.gov. But this problem is not mentioned. It indicates, "Payments are being delivered in record time" and it is "moving aggressively to provide additional information and resolve any issues."

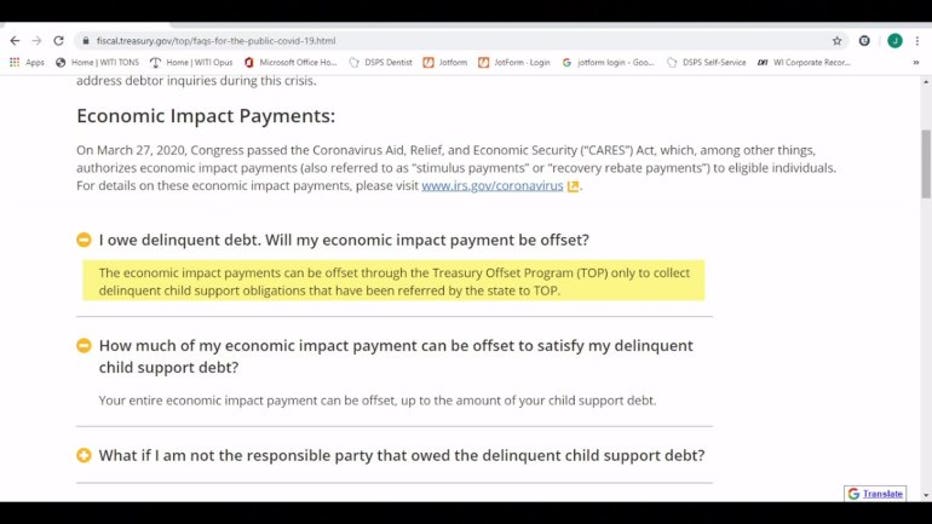

Vito Rivecco is having a very different issue. His stimulus payment was intercepted by child support.

"Times are hard and everybody needs as much as they can get," Rivecco said.

Rivecco lives with his fiancee and their two kids. He said his child support payment is actually a hospital bill for his son's birth -- and he is currently on a payment plan.

"Ten dollars a check, every check, and I've been paying it ever since," Rivecco said.

Kenosha County Child Support Services tells FOX6 News, "birth expenses due to the State of Wisconsin, are subject to interception until the obligation is paid in full even if the payer is current on a periodic payment."

The U.S. Treasury Department said if you have child support debt, "Your entire economic impact payment can be offset."

Last week, FOX6 News told you about another stimulus check issue. The IRS sending payments -- to ATC tax service -- instead of direct deposit to clients. Since then, customers have gotten updates telling them their money was being sent incorrectly to ATC a second time. ATC says on its Facebook page -- it has confirmed with the IRS that money will not come back to the bank, but will be mailed out directly instead.

Statement from IRS

"The IRS is working hard to deliver Economic Impact Payments to all eligible Americans as quickly as possible. These payments are being delivered in record time. The IRS is moving aggressively to provide additional information and resolve any issues. We appreciate taxpayers’ patience, and we will continue to share information and updates as they become available at IRS.gov/coronavirus."

IRS: Economic Impact Frequently Asked Questions

Statement from H&R Block

"The IRS has bank account information for all H&R Block clients who received tax refunds electronically, and is determining when and how stimulus payments are distributed. They have created confusion by not always using clients’ final destination bank account information for stimulus payments. We share our clients’ frustration that many of them have not yet received these much-needed payments due to IRS decisions, and we are actively working with the IRS to get stimulus payments sent directly to client accounts.

"For your question about the IRS tool error messages a client received, without specific information on this client, we’re not able to speculate as to what may have occurred. The IRS Get My Payment tool is the single location for people to update where their payment is distributed. According to the IRS, the Get My Payment tool does not allow people to change bank account information already on file with the IRS to help protect against potential fraud.

"The IRS says if the bank account is closed or if they have incorrect information, the deposit will be rejected, and you will be issued your payment to the address the IRS has on file for you. If the Get My Payment tool indicates your payment has been processed, you cannot change your bank account information."