Another day to save: Today's mortgage rates still steady and low | Feb. 3, 2022

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Check out the mortgage rates for Feb. 3, 2022, which are unchanged from yesterday. (iStock)

Based on data compiled by Credible, mortgage rates remained unchanged since yesterday.

- 30-year fixed mortgage rates: 3.625%, unchanged

- 20-year fixed mortgage rates: 3.250%, unchanged

- 15-year fixed mortgage rates: 2.750%, unchanged

- 10-year fixed mortgage rates: 2.625%, unchanged

Rates last updated on Feb. 3, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

What this means: It’s been a relatively calm week for mortgage rates, which are down overall from last week at this time. But experts widely predict things won’t stay this way for much longer. Buyers who can secure a 30-, 60- or 90-day rate lock today stand to save on interest when rates begin to rise again.

These rates are based on the assumptions shown here. Actual rates may vary.

To find the best mortgage rate, start by using Credible, which can show you current mortgage and refinance rates:

Browse rates from multiple lenders so you can make an informed decision about your home loan.

Credible, a personal finance marketplace, has 4,500 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

Looking at today’s mortgage refinance rates

Today’s refinance rates could afford homeowners significant interest savings, no matter which repayment term they choose. But 10-year rates are today’s standout value. It’s been seven days since 10-year rates sat at this level, and they haven’t been lower in 21 days. If you’re considering refinancing an existing home, check out what refinance rates look like:

- 30-year fixed-rate refinance: 3.625%, unchanged

- 20-year fixed-rate refinance: 3.250%, unchanged

- 15-year fixed-rate refinance: 2.750%, down from 2.875%, -0.125

- 10-year fixed-rate refinance: 2.625%, down from 2.875%, -0.250

Rates last updated on Feb. 3, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

A site like Credible can be a big help when you’re ready to compare mortgage refinance loans. Credible lets you see prequalified rates for conventional mortgages from multiple lenders all within a few minutes. Visit Credible today to get started.

Credible has earned a 4.7-star rating (out of a possible 5.0) on Trustpilot and more than 4,500 reviews from customers who have safely compared prequalified rates.

How to choose a mortgage lender

A mortgage is likely the largest debt you’ll take on in life — one that will take decades to repay. So it’s critical to make sure you choose a mortgage lender and mortgage that work best for your needs and financial situation.

Here are some tips to help you choose a mortgage lender:

- Comparison shop. Compare rates and terms from multiple lenders. Just as you comparison shop for less important purchases, you should compare offers from several lenders. A Freddie Mac study found that adding just one quote to your mortgage search could save you $1,500 over the life of a loan. Adding five could save you about $3,000. Credible makes it easy to compare your prequalified rates from multiple lenders.

- Consider a mortgage broker. Mortgage brokers can do the legwork for you when it comes to finding a loan deal. But be aware that mortgage brokers typically make money by charging a small percentage of the loan for their services.

- Leverage relationships. Explore mortgage offerings from banks and financial institutions you already do business with. Loyalty and familiarity may work in your favor in negotiating a good mortgage deal.

- Look for referrals. Ask friends, family, coworkers, and neighbors for referrals, and about their experiences with different lenders.

Current mortgage rates

The average mortgage interest rate across all repayment terms sits at 3.063% for a third consecutive day. Last week at this time, the average rate hit 3.204%, the highest it’s been in more than a year.

Current 30-year mortgage rates

The current interest rate for a 30-year fixed-rate mortgage is 3.625%. This is the same as yesterday. Thirty years is the most common repayment term for mortgages because 30-year mortgages typically give you a lower monthly payment. But they also typically come with higher interest rates, meaning you’ll ultimately pay more in interest over the life of the loan.

Current 20-year mortgage rates

The current interest rate for a 20-year fixed-rate mortgage is 3.250%. This is the same as yesterday. Shortening your repayment term by just 10 years can mean you’ll get a lower interest rate — and pay less in total interest over the life of the loan.

Current 15-year mortgage rates

The current interest rate for a 15-year fixed-rate mortgage is 2.750%. This is the same as yesterday. Fifteen-year mortgages are the second most-common mortgage term. A 15-year mortgage may help you get a lower rate than a 30-year term — and pay less interest over the life of the loan — while keeping monthly payments manageable.

Current 10-year mortgage rates

The current interest rate for a 10-year fixed-rate mortgage is 2.625%. This is the same as yesterday. Although less common than 30-year and 15-year mortgages, a 10-year fixed rate mortgage typically gives you lower interest rates and lifetime interest costs, but a higher monthly mortgage payment.

You can explore your mortgage options in minutes by visiting Credible to compare current rates from various lenders who offer mortgage refinancing as well as home loans. Check out Credible and get prequalified today, and take a look at today’s refinance rates through the link below.

Thousands of Trustpilot reviewers rate Credible "excellent."

Rates last updated on Feb. 3, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

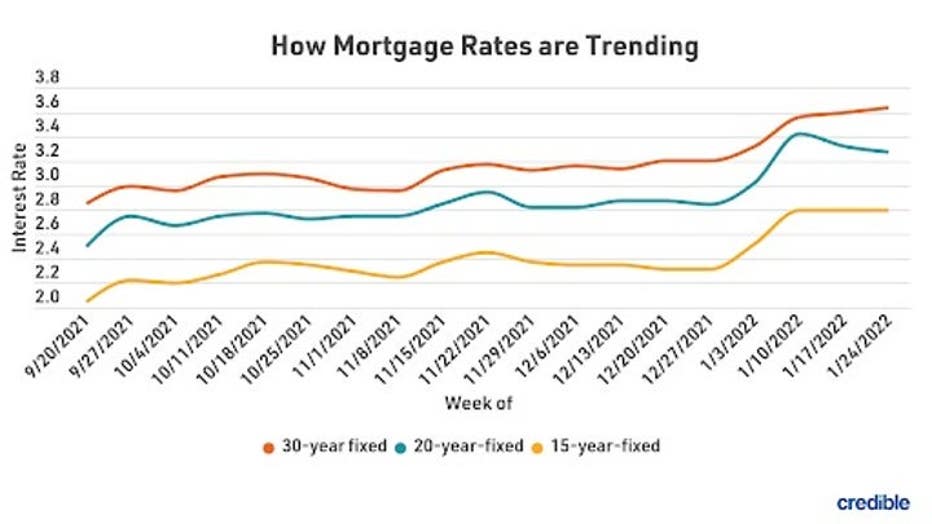

How mortgage rates have changed

Today, mortgage rates are down compared to this time last week.

- 30-year fixed mortgage rates: 3.625%, down from 3.690% last week, -0.065

- 20-year fixed mortgage rates: 3.250%, down from 3.375% last week, -0.125

- 15-year fixed mortgage rates: 2.750%, down from 2.875% last week, -0.125

- 10-year fixed mortgage rates: 2.625%, down from 2.875% last week, -0.250

Rates last updated on Feb. 3, 2022. These rates are based on the assumptions shown here. Actual rates may vary.

If you’re trying to find the right rate for your home mortgage or looking to refinance an existing home, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

With more than 4,500 reviews, Credible maintains an "excellent" Trustpilot score.

How large of a down payment do you need?

A down payment is your initial investment in your home. It’s the portion of a home’s purchase price that you’re able to pay in cash, out of your own pocket, while borrowing the balance.

You’ll typically need to have some money for a down payment when you buy a home. How much you need can vary, depending on the lender and the type of mortgage. For example, Federal Housing Administration (FHA) mortgages have minimum down payment requirements of just 3.5%. Conventional fixed-rate loans often require 5% down payments, while VA and USDA loans don’t require you to have a down payment at all.

Keep in mind that the bigger your down payment, the more likely you are to qualify for a better deal on a mortgage. If your credit is good and you can put down 20% or more, you may be able to qualify for a very good interest rate. Plus, sellers often prefer buyers with higher down payments.

Finally, a 20% down payment will typically mean your lender won’t require private mortgage insurance. PMI protects the lender if you default on the loan, and it increases your monthly mortgage payment. The cost of PMI can vary widely, but it’s typically based on a percentage of your home’s purchase price.

Looking to lower your home insurance rate?

A home insurance policy can help cover unexpected costs you may incur during home ownership, such as structural damage and destruction or stolen personal property. Coverage can vary widely among insurers, so it’s wise to shop around and compare policy quotes.

Credible is partnered with a home insurance broker. If you're looking for a better rate on home insurance and are considering switching providers, consider using an online broker. You can compare quotes from top-rated insurance carriers in your area — it's fast, easy, and the whole process can be completed entirely online.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.