Getting out of debt is a top New Year's resolution, study finds

Most consumers are considering a financial New Year's resolution, according to a recent study from Fidelity. Keep reading to learn how you can meet your financial goals in 2022. (iStock)

Following a year marred by record-high inflation and soaring personal debt, 2022 is a clean slate for many consumers who want to improve their finances. The majority (68%) of Americans are considering a New Year's financial resolution, according to a recent study from Fidelity.

Among consumers who are considering a financial resolution, the most popular goals are to increase their savings (43%), pay off debt (41%) and spend less money (31%).

It's no surprise that 2 in 5 Americans want to get out of debt in 2022. Revolving credit balances ballooned nearly 6%, according to the Federal Reserve, surpassing $1 trillion in August for the first time since the COVID-19 pandemic began.

If you've resolved to pay down debt in the New Year, consider the three debt repayment strategies in the sections below. You can visit Credible to compare rates on a number of financial products, from debt consolidation loans to balance-transfer cards.

HOW TO PLAN FOR UNEXPECTED EXPENSES — AND STILL SAVE

How to pay off debt in the New Year

Putting extra money toward your debt payments every month is one way to become debt-free, but it's not your only option. It may be possible to get out of debt faster and save money in the process by using one of these debt payoff strategies:

Keep reading to learn more about each option, so you can determine the best way to pay off debt for your unique financial situation.

DEBT SNOWBALL METHOD VS. DEBT AVALANCHE METHOD

Debt consolidation loans

It may be possible to pay off your existing debt at a lower interest rate with a debt consolidation loan. This is a type of lump-sum personal loan that's used to consolidate virtually any type of debt, including credit cards, auto loans and medical bills.

Debt consolidation loans have fixed interest rates, which means you'll have a predictable debt repayment plan. Your monthly payments will always stay the same, and you'll know exactly how many months are left until your loan is paid in full.

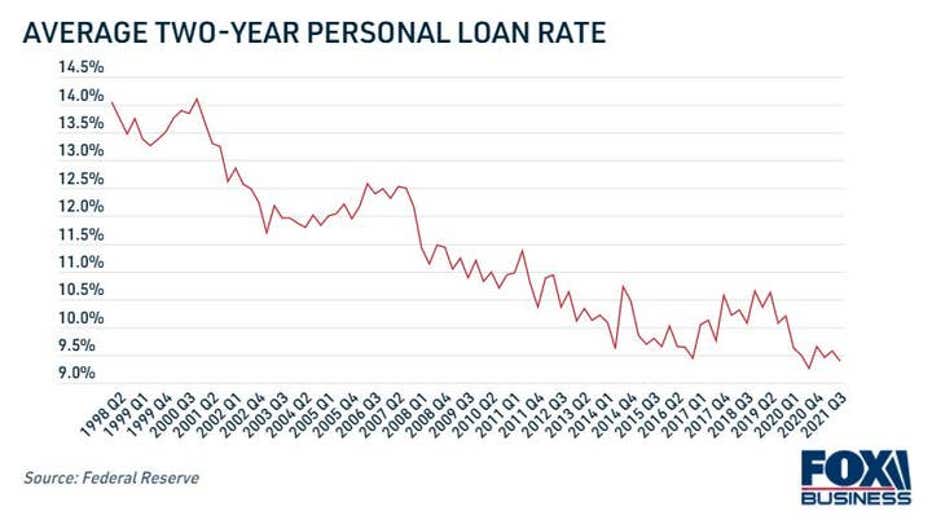

As an added bonus, average personal loan interest rates are near record lows at 9.39%, according to the Fed. The rate you're offered depends on a number of factors, including your credit score and debt-to-income ratio.

HOW DO I BUILD AN EMERGENCY FUND?

A recent study from Credible found that borrowers have the opportunity to save nearly $2,400 by consolidating high-interest credit card debt into a personal loan. Determine your potential savings and estimated monthly payments by using a personal loan calculator.

If you decide to borrow a personal loan to consolidate debt, it's important that you compare rates across multiple lenders to find the lowest rate possible for your situation. Visit Credible to see your personal loan offers for free without impacting your credit score.

CREDIT CARD REWARDS CAN HELP PAY FOR GROCERIES DURING CORONAVIRUS PANDEMIC

Balance-transfer cards

Making the minimum payment on your credit cards is a quick way to rack up high-interest debt that's difficult and expensive to repay. If you're in this situation, consider using a balance transfer to pay off credit card debt at a lower rate.

This debt payoff strategy is when you move one or more credit card balances to a new card. Some credit card issuers also offer an introductory 0% APR period, during which you have up to 18 months to repay your current debt without paying interest. These zero-interest offers are reserved for borrowers with very good credit, which is defined as 740 or above using the FICO model.

Credit card issuers may charge a 3-5% balance-transfer fee, but this will typically be offset by the total interest savings. You can compare balance-transfer credit cards on Credible to decide if this option is right for you.

FANNIE MAE TO CONSIDER ON-TIME RENT PAYMENTS WHEN UNDERWRITING MORTGAGES

Nonprofit credit counseling

Credit counseling agencies offer free or low-cost services for consumers who are struggling to repay unmanageable debt, including:

- Financial education. A personal finance expert can analyze your monthly bills to help you curb unhealthy spending habits and create a budget.

- Debt management plans (DMPs). A credit counselor may enroll you in a DMP to help you structure your debt payments based on your income and expenses.

- Debt settlement. A counselor may negotiate with creditors on your behalf to reduce your interest rates and even settle your debts for less than what you owe.

Nonprofit credit counseling is a good option for borrowers with low incomes and bad credit, since it comes at a low cost and doesn't require a credit check. A credit counselor may also help you determine if bankruptcy is the best option for your situation. Visit the Department of Justice website for a list of accredited credit counseling agencies in your area.

You can learn more about your alternative debt management options, including personal loans and balance-transfer credit cards, by getting in touch with a knowledgeable loan officer at Credible.

HOW TO GET THE BEST RATE ON A HOME EQUITY LINE OF CREDIT

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.