FOX6 Cents: What to do if your bank fails

FOX6 Cents: What to do if your bank fails

You expect the money you put in the bank will be there when you need to withdraw. But that isn’t always the case.

MILWAUKEE - You expect the money you put in the bank will be there when you need to withdraw. But that isn’t always the case. What happens if your bank fails and closes for good?

Consider these four letters your savings safety net at the bank: FDIC. The Federal Deposit Insurance Corporation (FDIC) came about during the Great Depression to help restore trust in the banking industry. If something were to happen to your bank today, the federal government insures your deposits up to $250,000.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

"I have been working in the banking industry for about 30 years," said Kelly Brown.

Brown is the CEO of Waukesha’s Ampersand Inc. She's on a mission to make sure any money you have in the bank beyond that $250,000 stays with you.

Kelly Brown, CEO of Ampersand Inc.

"Yeah, it is scary. It absolutely is. Banks are not failsafe. They are like any other business in this country," she said.

"What we do is protect all of that money through a network of banks and never have more than $250,000 at any one bank, ensuring that those deposits are protected at all times," Brown added.

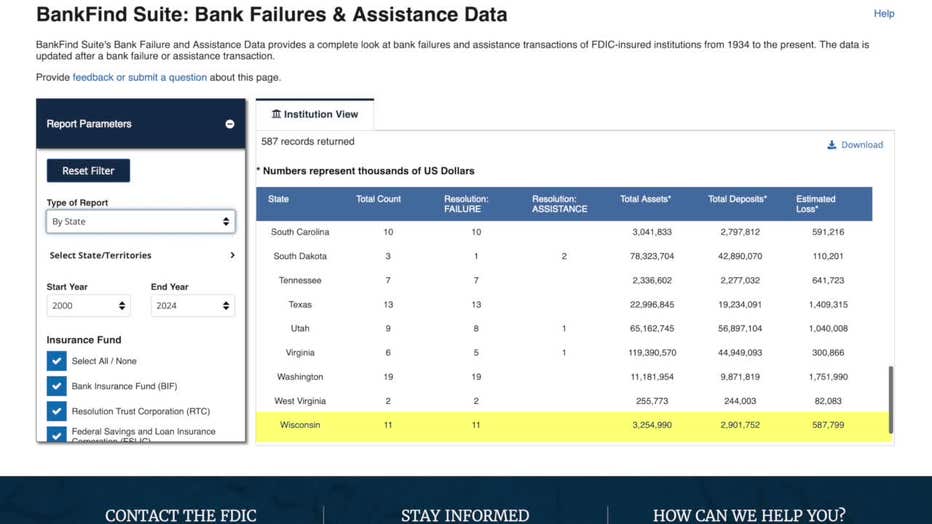

FDIC lists 11 Wisconsin banks that have failed since the year 2000

If you think your bank is safe, Brown urges you to take a second look. The FDIC lists 11 Wisconsin banks that have failed since the year 2000.

"Why do banks fail?" asked FOX6's Bret Lemoine.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android

"Some banks maybe got a little too aggressive with their investments," said Bob Kraft.

Kraft helps foreign investors become permanent residents through Milwaukee’s FirstPathway Partners. He said small, local banks are critical to any community. Kraft worries about banks that have heavily invested in commercial real estate and the hospitality industry. Both have been hurting since the COVID-19 pandemic.

Bob Kraft, CEO of FirstPathway Partners

"There have been a number of bank failures – in fact there was one just recently in Oklahoma that hasn’t been reported on nationally," Kraft said. "It was a smaller bank and if you had more than $250,000 in the bank, you lost 50 cents on the dollar of that amount."

"Without the local community bank, a lot of small businesses wouldn’t be able to operate the way they do today," said Brown.

Ampersand Inc. explains financial failsafes

Suzanne Hoeppner, COO of Ampersand Inc., discusses financial failsafes and what to do if your bank fails.

If all this talk about bank failures has you worried, Brown has some advice.

Stagger your investments across multiple banks or credit unions. Make sure your balance at each is under the $250,000 in order to be protected by the FDIC. And before you open an account anywhere, sit down with a banker and ask them some questions.

"What are the plans for the bank in the next 1-3 years?" Brown said. "Are you closing branches? Are you opening branches? Are you investing in technology?"

Brown suggests BankRate.com as a resource.

Those are some checks that will hopefully pay dividends down the road. "Wisconsin has some of the strongest, most well-run profitable banks in the entire country," Brown said. FOX6 wanted to know their secret. "The secret is the Wisconsin people and the work ethic we have here," Brown added.