Fraud or mistake? Claimants say unemployment system punishes confusion

Claimants say unemployment system punishes confusion

In Wisconsin, a fraud determination means loss of future unemployment benefits.

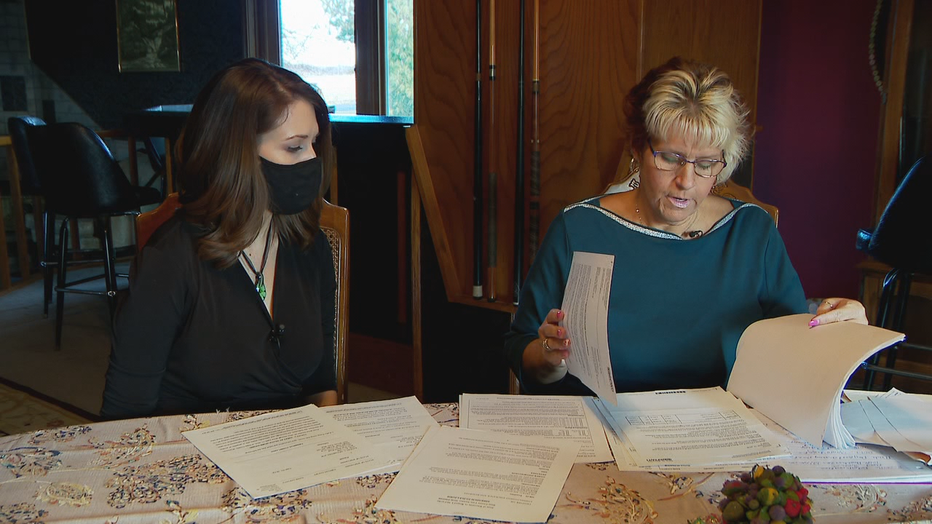

MILWAUKEE - Amanda Johnson says a $300 unemployment mistake ended up costing her $12,411.

"I wouldn’t wish this on anybody," Johnson said during an interview in her Ozaukee County home. "I never thought it would come back so dramatically."

In fall 2017, Johnson was out of a job and receiving unemployment benefits. She says she received a $300 check for children's dance classes she had taught months before.

"And I cashed it, not thinking I did anything wrong, not thinking that was against the rules," Johnson said.

Months later, well after Johnson had found a new job, she received a notice from the Wisconsin Department of Workforce Development, which oversees the state's unemployment payments, accusing her of concealing her work at the dance studio and accusing her of unemployment fraud.

Amanda Johnson

"I sat in this living room and I cried and I cried," Johnson said.

Johnson's situation wasn't unique before the pandemic. But now that Wisconsin's unemployment system has been flooded with claims, employment attorneys, employment policy advocates, and claimants say they're concerned increasing numbers of people will be punished for making mistakes.

How it works

Johnson couldn't just pay back the $300 difference; she needed to repay all her unemployment benefits, plus a 40 percent fine for fraud. Out of pocket, it cost her $4,851.

She found a new job, but lost it in 2020 due to the pandemic. When Johnson applied for unemployment benefits, she discovered she could not receive them.

In Wisconsin, as in several other states, a fraud determination means loss of future unemployment benefits. The benefit reduction lasts for six years or until the claimant has repaid a certain amount. This is not a penalty that can be paid out of pocket; the benefit reduction must be satisfied through filing unemployment claims, which then go back to the state instead of going to the claimant.

Johnson's benefit reduction is $7,560, on top of the fines and money she already paid back to the state. It's how what she calls a $300 mistake added up to $12,411.

"I was just teaching some kids some ballet," Johnson said. "I was not trying to defraud the state of Wisconsin. I really wasn’t."

Breaking down the numbers

When the Department of Workforce Development (DWD) determines someone gets more unemployment benefits than they were supposed to receive, it's called an overpayment; the claimant is required to repay that amount. If DWD determines the claimant intentionally concealed information while filling out claims, that overpayment is categorized as fraud and the penalties kick in.

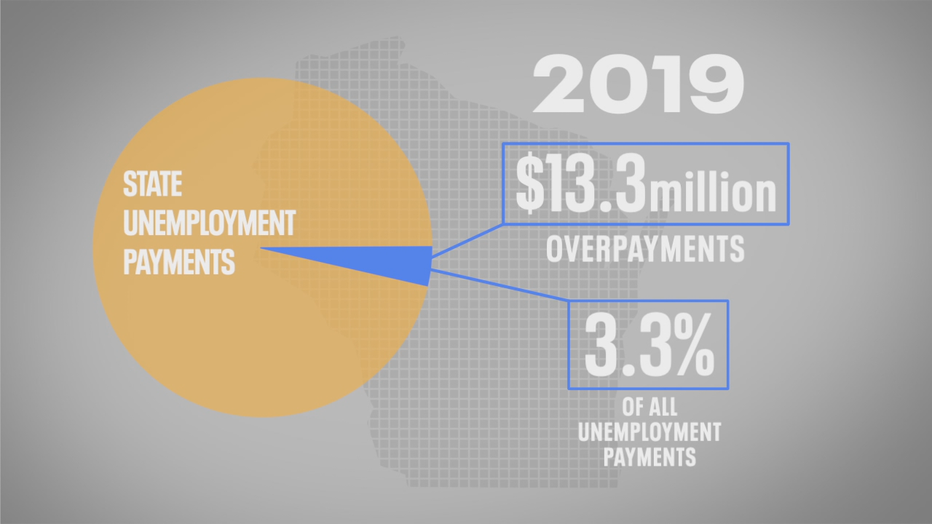

Public records show in 2019, Wisconsin reported detecting $13.3 million in unemployment overpayments, representing 3.3% of all claims the state paid out. Of the $13.3 million, the state categorized $4.7 million as fraud.

In the first six months of the pandemic, during which unemployment claims flooded the system, DWD reports detecting $33.9 million in overpayments, representing one percent of all claims the state paid out.

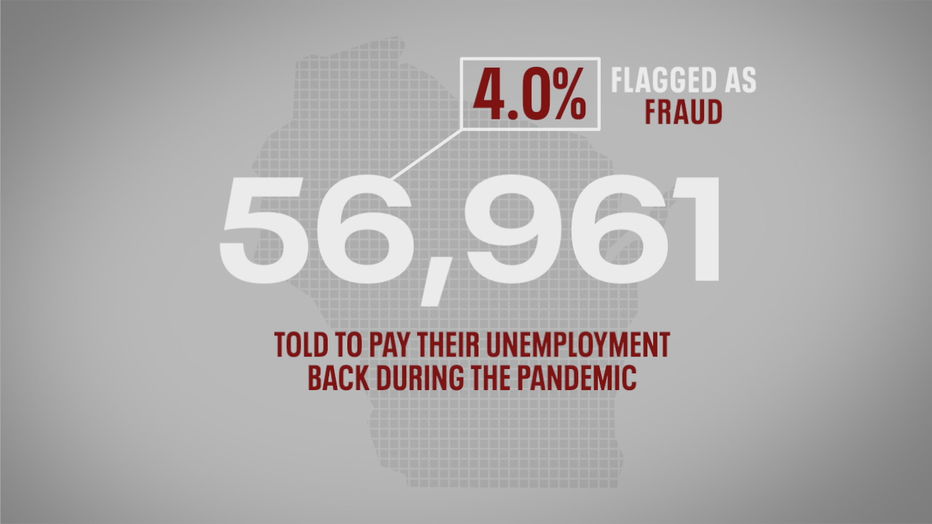

While the overpayment rate so far during the pandemic is lower than it was in 2019, public records show the impact is large; 56,961 claimants between March 16, 2020 and October 14, 2020 have been informed they were overpaid and need to repay unemployment benefits.

The state has flagged at least $1.4 million, or roughly four percent, of overpayments detected during the pandemic as fraud.

It can take months for the state to notify claimants they were overpaid; employment attorneys say they expect the amount of pandemic overpayment notices to grow.

'A problem no one wants to address'

"You make a mistake, you do something wrong, they go after you," employment attorney Victor Forberger said, referring to Wisconsin's unemployment system. "Before this pandemic, I was telling people not to file for unemployment benefits because it was too dangerous."

Over the last several years, Wisconsin has adopted laws and practices to fight unemployment fraud. But Forberger says the system has become so complicated, it's too easy for claimants to make honest mistakes and too difficult to prove those mistakes aren't fraud.

Victor Forberger

"It’s a problem no one wants to address," Forberger said.

Wisconsin's Department of Justice prosecutes unemployment fraud. FOX6 asked for an on-camera interview; no one responded. DWD declined an interview request, but spokesperson Ben Jedd did answer some questions via email.

Jedd says the percentage of overpayments detected so far during the pandemic is "uncharacteristically low" compared to the last nine years.

"Each case is individual, fact-specific, and stands on its own," Jedd wrote. "If the claimant disagrees with the determination issued, they have the right to appeal that determination; those directions are on the back of the claim."

Although Wisconsin detected $13.9 million in overpayments in 2019, after adding up fraud fines and reduction in future benefits, that same year the state collected $18.2 million. Wisconsin's 2020 Fraud report says both the amount detected and the amount collected in each year encompass overpayments that may have occurred in prior years.

Public records show in each of the last five years, Wisconsin has collected more overpayments and associated fraud penalties than it paid out.

"So the [Department of Workforce Development] right now has a financial incentive for charging fraud," Forberger said.

Forberger says because it can take months for DWD to flag claims as overpayments and fraud, the repayments and fines balloon to large amounts before claimants have a chance to correct mistakes.

FOX6 asked DWD if there was any plan in place to speed up the process of alerting claimants they were overpaid. Jedd did not answer the question, responding, "A determination is issued after the investigation is complete." He also added that anyone who was overpaid but cannot afford to pay their benefits back due to the pandemic should speak to the DWD collections department about payment options.

Beyond the money

When a claimant is flagged for fraud, the end result can be more serious than hefty fines.

"I'm going to jail for this?" Raquel McCarthy remembers wondering as she fought fraud charges.

Raquel McCarthy

McCarthy told FOX6 what documents show she told the Department of Workforce Development - that she was confused when filing her unemployment claims five years ago and did not report the hours she worked at a temp job.

"I made an honest mistake," McCarthy said.

The Department of Workforce Development determined McCarthy's case was fraud. Although most unemployment fraud cases don't end up in court, McCarthy's case was referred for criminal charges while she says she was attempting to repay her unemployment benefits and the additional fraud fines.

"I’m going up against unemployment," McCarthy said. "How am I going to do that?"

McCarthy pled down to a misdemeanor in an attempt to keep a felony off her record. She eventually found new employment, but is now out of a job due to the pandemic. Due to her benefit reduction, she currently cannot collect unemployment benefits.

"You don’t know are you going to be able to eat, pay your heat bill," McCarthy said. "It’s just, it’s scary....all because of a mistake."

"This is not at all unique to Wisconsin," Michele Evermore, National Employment Law Project senior researcher and policy analyst, told FOX6.

Evermore says the systems most states have for detecting fraud make it too easy to penalize people who make mistakes.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android

"A lot of these people who have been flagged for fraud really did just make an innocent mistake at some point," Evermore said. "That shouldn’t hang around and hurt them when the economy crumbles again."

"If a bunch of people get flagged for fraud, and all of a sudden there’s a recession and those people aren’t able to get unemployment insurance benefits, they can’t spend it in the local economy," Evermore added.

Evermore says if you get a notice that you were overpaid and/or accused of fraud, and you believe that determination is wrong, the best thing you can do is appeal.

"It will take a while, but this is really important that you make sure that you are not accused of fraud for something that really is not your fault," Evermore said.