Innovative lending services look to help small businesses

MILWAUKEE - Local businesses are receiving a boost of support this Small Business Saturday, but it may not be enough to get many of them through the COVID-19 pandemic.

As many wait and wait for another round of relief checks from the federal government, there are more new loan opportunities popping up.

Some financial opportunities have innovative models designed for getting small businesses through the roller coaster ride that has been surviving through the pandemic.

"In your tough weeks, which we’re going to have a lot of them coming up, unfortunately, you’re not going to be able to do it," said David Braeger, founder of Terrapin Funding.

RELATED: Read more stories about small businesses at fox6now.com

Braeger is a local venture capitalist who says he is founding a solution, Terrapin Funding, in Mequon. He said he will soon be dishing out millions of dollars to restaurants, bars and other businesses with flexibility and approval that borrowers may not be able to find in more traditional government or big-bank loans.

"The loans have to be designed so that when you go up and down and we finally hopefully get to this grand reset you’re able to pay in ebbs and flows to keep you in business," Braeger said.

With many new loan options available because of the pandemic, and many banks saying "no," experts warn business owners that, before getting desperate, do research on non-traditional loans. Those loans may be right for one owner, but not another.

Braeger believes that ideas like his are the new frontier for financial security for the ma-and-pop places that communities know and love.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android.

"It’s really challenging. When we have the grand reopening, we have to be able to reopen and that means the establishments are going to need funding and support," said Braeger.

Organizations such as the Better Business Bureau and Small Business Administration provide additional advice for business owners. For more localized advice, visit the SBA's Wisconsin District Office online at sba.gov/offices/district/wi/milwaukee.

Featured

Milwaukee 'Scroll & Stroll' aims to boost small business

Smaller businesses need community support now more than ever as local spots close down or adapt due to COVID-19.

Featured

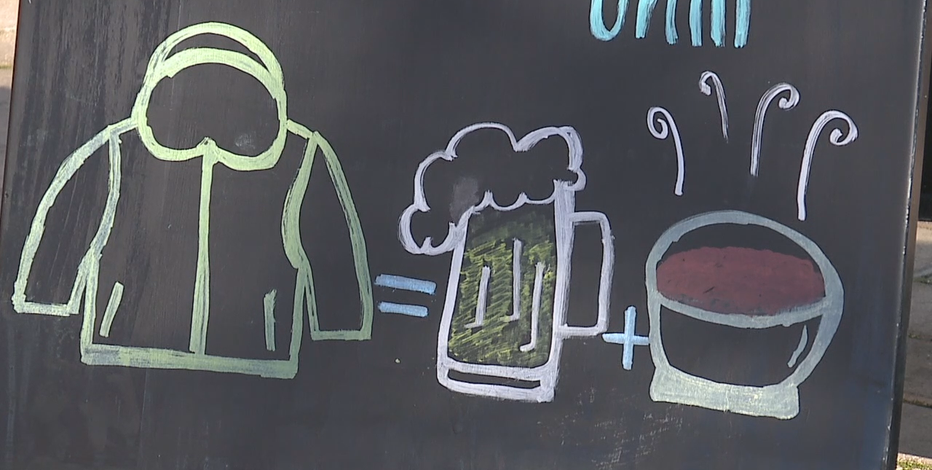

Donors swap coats for chili, beer at Cafe Hollander

The Lowlands Restaurant Group traded chili and beer -- or a hot cocoa -- for coats at the socially-distanced outdoor event.