Milwaukee County facing $19M deficit, even after raising sales tax

Milwaukee County facing $19M deficit

The Milwaukee County Office of Strategy, Budget and Performance is looking at ways to offset the deficit, which could include using extra money from other departments.

MILWAUKEE COUNTY, Wis. - The sales tax grew, but the returns have not.

Now Milwaukee County is expecting its budget deficit to grow as high as $19 million. The tax increase started Jan. 1.

It leaves county leaders looking for solutions on how to properly spend your money.

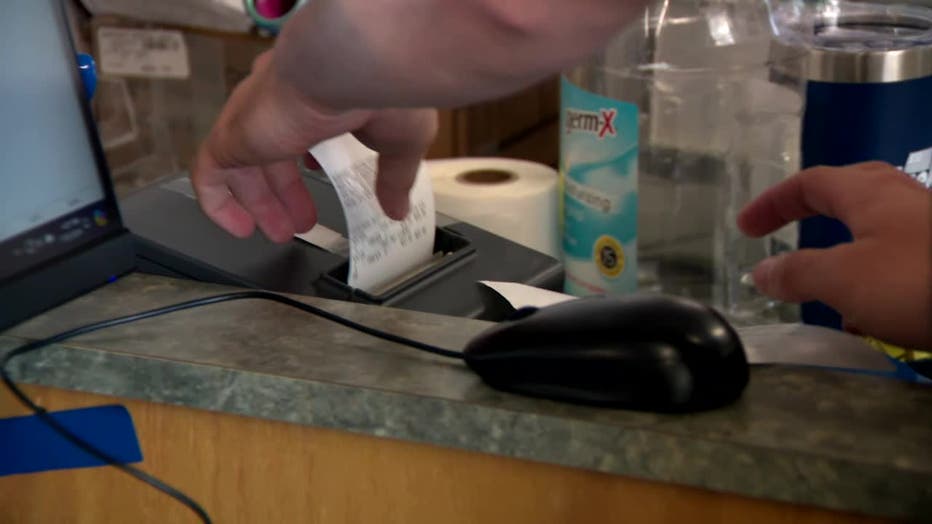

On a Wednesday afternoon at Burghardt Sporting Goods in Fox Point, for fifth-generation owner Brian Burghardt, the post-pandemic spending spike is swinging back toward reality.

"There was a ton of pent-up demand," Burghardt said. "I think that we're flattening out a little bit right now. Business is still strong, but we're not enjoying the same trend as we have in the previous couple years."

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

Slower retail sales spells smaller sales tax collections, which is part of the reason the Milwaukee County Comptroller's Office said it's now looking at a $19 million deficit, even after raising the sales tax from 0.5% to 0.9%.

"Our sales tax budget assumed a 3%, I believe, increase over last year's number," said Cynthia "CJ" Pahl, Financial Services Manager for the Milwaukee County Comptroller's Office. "And when we're not hitting that, and we're not even hitting last year's budget, that's when we're in trouble."

Pahl said overtime for the Milwaukee County Sheriff’s Office, a food contract at the Community Reintegration Center and a $2.5 million payment as part of the American Family Field funding fix are to blame as well.

"It’s not good," said Milwaukee County Supervisor Steve Taylor. "It's not good at all."

They are hoping a little more business could help everyone.

The Milwaukee County Office of Strategy, Budget and Performance is looking at ways to offset the deficit, which could include using extra money from other departments.

The office will present a plan to address the deficit in September.

What is taxable?

According to the state, sales tax is imposed on retailers who make taxable retail sales, licenses, leases, or rentals of the following products in Wisconsin (unless an exemption applies):

- Tangible personal property

- Coins and stamps of the United States that are sold, licensed, leased, rented or traded as collector's items, above their face value.

- Leased tangible personal property affixed to real property, if the lessor has the right to remove the leased property upon breach or termination of the lease agreement. Exception: A lessor's charge for the lease of tangible personal property affixed to real property is not taxable if the lessor of the leased property is also the lessor of the real property to which the leased property is affixed.

- Certain digital goods

In addition, certain services which are sold, licensed, performed, or furnished at retail in Wisconsin are subject to Wisconsin sales or use tax, unless the service provider or the buyer is exempt from tax on that transaction.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android.

Tangible personal property is personal property that can be seen, weighed, measured, felt, or touched, or that is in any other manner perceptible to the senses. Examples include:

- Clothing

- Computers

- Office equipment

- Electricity

- Gas

- Steam

- Water

- Prewritten computer software, regardless of how it is delivered (i.e., physical media or download)

Only certain services sold, performed, or furnished in Wisconsin are subject to Wisconsin sales or use tax. Taxable services include:

- Admission and access privileges to amusement, athletic, entertainment, or recreational places or events.

- Access or use of amusement devices

- Boat docking and storage

- Cable television services

- Contracts for future performance of services

- Internet access (not taxable beginning July 1, 2020)

- Landscaping and lawn maintenance services

- Laundry and dry cleaning services

- Parking services for motor vehicles and aircraft

- Photographic services

- Producing, fabricating and printing

- Repair and service of tangible personal property, items, property, or goods (Part 10.B.9 in Publication 201)

- Rooms or lodging for less than one month

- Telecommunications message services

- Telecommunications services, including prepaid calling services, and ancillary services

- Towing and hauling of motor vehicles by a tow truck

When a retailer sells taxable products or services which are subject to tax, and the retailer charges the purchaser for delivery, the retailer's total charge, including the delivery charge, is taxable. This is the case whether the seller's vehicle, a common or contract carrier, or the United States Postal Service makes delivery.

Exceptions:

- The sales price of direct mail does not include separately stated delivery charges.

- Transportation or delivery charges paid by the Wisconsin purchaser to a carrier which is independent of the seller.