Milwaukee property assessments spike, tax concerns; what owners can do

Milwaukee property assessments, tax concerns

New Milwaukee property assessments just went out, and FOX6 has been getting emails from people concerned that their taxes will go up.

MILWAUKEE - New Milwaukee property assessments just went out, with the average homeowner seeing a 17.7% increase in the valuation. Some taxpayers say they're worried their taxes will go up.

Ninety-three percent of properties in the city have higher assessments this year, Milwaukee's assessor said. The average increase for both residential and commercial is 13%.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

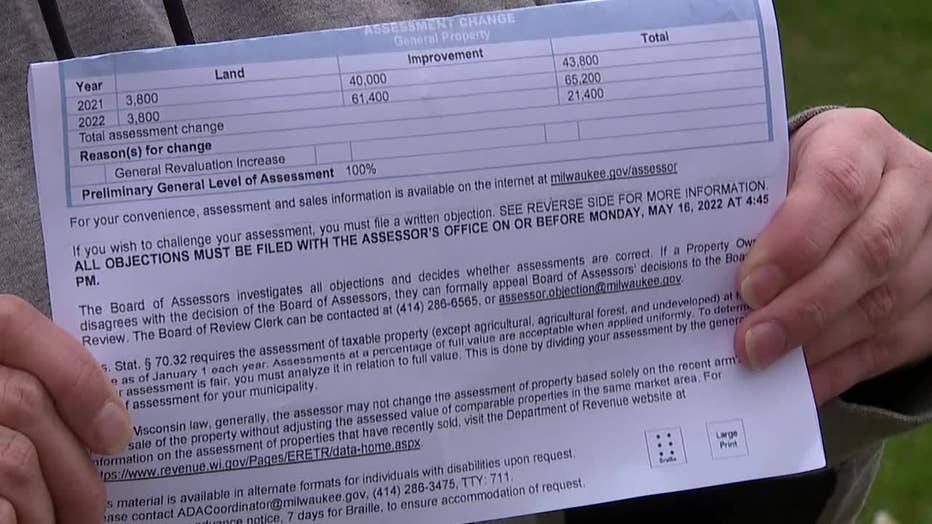

The last two years, Catherine Petersen's Hampton Heights home was assessed at $43,800. Now, it's $65,200.

"It’s an unfair increase in value. If they want to increase a property by 50%, they should come out here, look at the property themselves and decide for themselves how much they are going to increase."

Catherine Petersen shares property assessment

Petersen said a medical condition keeps her from many jobs, and she's worried about her mom who has owned the home since 1988.

"That’s going to be a major increase in costs for us, with a limited budget for our household," said Petersen. "That’s going to be a major hit for us."

Even though the assessed value went up, it does not automatically mean higher taxes. Local governments will set the tax rates later this year, something called a mill rate.

"The mill rate might go down, but the assessment might go up. The mill rate could even that out. And the taxes might be somewhat similar to what they were last year," said Tim Klingman, president of North Shore Homes.

"I don’t think we’ll really know," he added about tax rates. "It’s really going to depend on what the ultimate budget for the next year is and how that is really spread out amongst the city and the various districts."

Milwaukee City Assessor's office

Why the big jump in this year's assessments? Milwaukee did not reassess property values in 2021, so this year's increase represents two years of growing home values.

"The market, the free market really determines what the assessed value should look like for the city," said Nicole Larsen, Milwaukee commissioner of assessments.

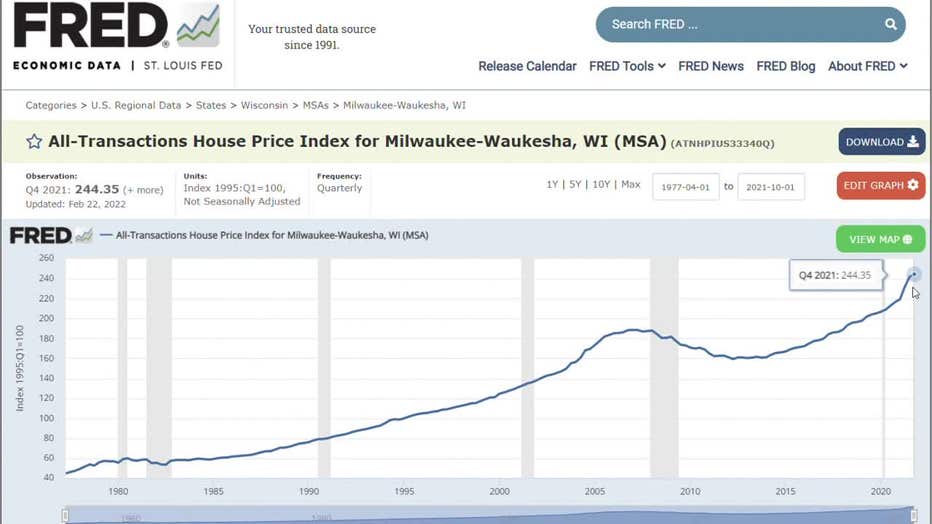

The St. Louis Federal Reserve Bank shows how home values in the Milwaukee area have spiked.

St. Louis Federal Reserve Bank data

Realtors confirm it's a hot market.

"It’s still very competitive. A seller’s market, indeed. When I’ve written offers for buyers, I’ve been up against from 20-40 offers," Klingman said.

If you want to challenge your assessment, this city website will help. The deadline to apply is the third Monday of May, which this year is May 16.

During a recent hearing, before assessments were mailed, Alderman Bob Bauman warned the assessor, "I hope you guys have your crash helmets on when these values hit people’s mailboxes, especially in some of these lower income districts."

The city assessor told FOX6 so far 660 people have appealed this year's assessments. That is not near what was seen in 2020, when that number was more than 5,700.

Larsen added that property owners can challenge their assessment by sharing photos showing the condition of their homes and sale prices of similar ones.

For those who do appeal their assessment, an appraiser will review materials and may visit the property. Then, the Board of Assessors, which is made up of the assessor and her management team, will judge the case. Owners can appeal that decision to the Board of Review, which is made of appointees. Finally, a property owner could then go to court.

"Stay calm, stay patient. Any questions, please call us on our hotline," Larsen said.

The National Taxpayers Union Foundation estimates over-assessment impacts more than 30% and up to 60% of American properties. The group says, "Yet typically fewer than 5 percent of taxpayers challenge their assessments, even though the majority who do so win at least a partial victory when properly prepared."