Milwaukee city, county sales tax increase; what to expect in 2024

MKE sales tax increase; what to expect in 2024

Milwaukee's new sales tax and Milwaukee County's sales tax increase take effect Jan. 1, 2024. Here is what shoppers can expect.

MILWAUKEE - Higher federal income tax brackets and standard deductions will take effect in 2024. It could give Americans a chance to increase their take-home pay – shielding more of their income from the IRS.

While they might save on income taxes, shoppers in Milwaukee County still need to prepare to pay more at checkout. The new city sales tax and county sales tax increase start Jan. 1.

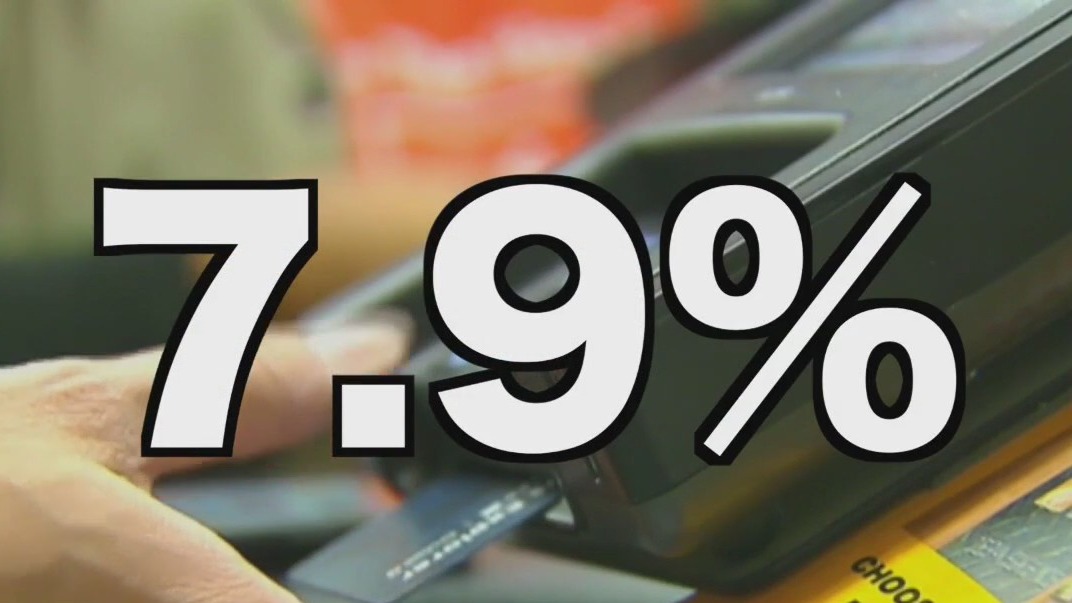

The city of Milwaukee will start a 2% sales tax and Milwaukee County will add 0.4% to the current 0.5% county sales tax. That means that instead of paying 5.5% on applicable purchases, people will pay 7.9% in the city. Some things are not taxable – like groceries, water, gasoline and prescription drugs.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

"I would probably still come because the store selection," said Kristine Wulff of Ozaukee County. "I mean, I don’t have the same store selection up where I live."

"It’s going to be harder. I’m going to have to work harder for it, to get the extra funding," said Jazzamin Green of Milwaukee. "I’m going to slow down. I’m going to slow down, because I have to budget."

Milwaukee's comptroller estimates the new tax could bring the city $184 million dollars per year. The money will mostly go toward a ballooning pension problem. City and county leaders warned that, without the new sales taxes, they would have faced a major budget crisis with crushing cuts. They spent many years urging state lawmakers to allow the local governments to raise the sales tax. That authorization finally came in 2023, with a bipartisan law passed by the Republican-controlled Wisconsin Legislature and signed by Democratic Gov. Tony Evers.

"I just am not happy with the fact that we had to impose the sales tax," said Keith Schmitz of Milwaukee. "We have a lot of money in the [state] surplus, and that should be going to helping not just Milwaukee, but other locales across the state."

"I understand it. I know why we have to do it, and so I’m just going to suck up and pay it. But, again, as I indicated, there were other means to do this other than a 2% sales tax."

Greenfield Motors

When it comes to cars, the Wisconsin sales tax is based on where you live – not where you buy. It means Milwaukee residents will see a 2.4% sales tax increase when they buy cars starting Jan. 1.

"I think it’s just going to slow down purchasing in general, because not just the money aspect but the people having to deal with the fact that another tax, another price increase," said Kevin Schuchardt, owner of Greenfield Motors.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android.

Schuchardt said they haven't seen a spike in people buying now to save on taxes; he said it has actually been a little slow.

"When they need to buy a car, they will come out and buy it, one way or another," Schuchardt said.

For a $12,000 vehicle, the added sales taxes would mean an extra $288 in sales tax for the person living in Milwaukee.

Despite the higher sales tax, Milwaukee's is still lower than cities in neighboring states:

Chicago: 10.25%

Minneapolis: 9.04%

Milwaukee sales and use taxes fact sheet

What is taxable?

According to the state, sales tax is imposed on retailers who make taxable retail sales, licenses, leases, or rentals of the following products in Wisconsin (unless an exemption applies):

- Tangible personal property

- Coins and stamps of the United States that are sold, licensed, leased, rented or traded as collector's items, above their face value.

- Leased tangible personal property affixed to real property, if the lessor has the right to remove the leased property upon breach or termination of the lease agreement. Exception: A lessor's charge for the lease of tangible personal property affixed to real property is not taxable if the lessor of the leased property is also the lessor of the real property to which the leased property is affixed.

- Certain digital goods

In addition, certain services which are sold, licensed, performed, or furnished at retail in Wisconsin are subject to Wisconsin sales or use tax, unless the service provider or the buyer is exempt from tax on that transaction.

Tangible personal property is personal property that can be seen, weighed, measured, felt, or touched, or that is in any other manner perceptible to the senses. Examples include:

- Clothing

- Computers

- Office equipment

- Electricity

- Gas

- Steam

- Water

- Prewritten computer software, regardless of how it is delivered (i.e., physical media or download)

Only certain services sold, performed, or furnished in Wisconsin are subject to Wisconsin sales or use tax. Taxable services include:

- Admission and access privileges to amusement, athletic, entertainment, or recreational places or events.

- Access or use of amusement devices

- Boat docking and storage

- Cable television services

- Contracts for future performance of services

- Internet access (not taxable beginning July 1, 2020)

- Landscaping and lawn maintenance services

- Laundry and dry cleaning services

- Parking services for motor vehicles and aircraft

- Photographic services

- Producing, fabricating and printing

- Repair and service of tangible personal property, items, property, or goods (Part 10.B.9 in Publication 201)

- Rooms or lodging for less than one month

- Telecommunications message services

- Telecommunications services, including prepaid calling services, and ancillary services

- Towing and hauling of motor vehicles by a tow truck

When a retailer sells taxable products or services which are subject to tax, and the retailer charges the purchaser for delivery, the retailer's total charge, including the delivery charge, is taxable. This is the case whether the seller's vehicle, a common or contract carrier, or the United States Postal Service makes delivery.

Exceptions:

- The sales price of direct mail does not include separately stated delivery charges.

- Transportation or delivery charges paid by the Wisconsin purchaser to a carrier which is independent of the seller.