Unemployment fraud: State seeks no criminal charges in 99.8% of cases

Unemployment fraud: State seeks no criminal charges in 99.8% of cases

Unemployment fraud: State seeks no criminal charges in 99.8% of cases

PORT WASHINGTON (WITI) -- The economy is improving, businesses are expanding and unemployment is the lowest it's been since 2008. So why are thousands of people with jobs still claiming they're jobless? It is a common form of fraud, but what's far less common is jail time for those caught ripping off the unemployment system. A FOX6 investigation finds the state did not seek criminal charges against tens of thousands of people suspected of filing false claims.

John Weinrich says that's irritating -- and you can hardly blame him. When Weinrich was 25, he quit his job as a cook and spent every dime he had to open his own restaurant.

"I lived in the basement for a couple years," Weinrich said.

A quarter century later, New Port Shores is a Port Washington landmark, and Weinrich is enjoying the spoils. But he earned it all the hard way.

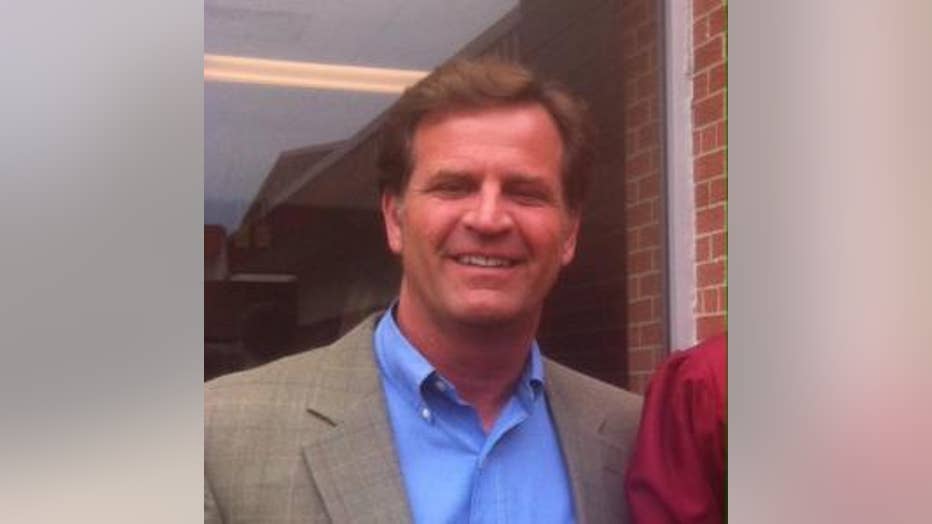

John Weinrich, a small business owner who pays taxes into the state's unemployment fund, says fraud is "irritating."

"So yeah, I get a little touchy when it comes to fraud," he said.

Like thousands of small business owners across Wisconsin, Weinrich pays a percentage of his payroll into the state's unemployment fund. It's a pool of money set aside to help workers survive a gap between jobs or a downturn in the economy.

But a FOX6 investigation finds that tens of thousands of people who are claiming unemployment benefits aren't supposed to be getting them.

People like David Wegmann -- a real estate salesman from Mequon who used to make six figures until the economy took a nose dive.

David Wegmann continued to receive unemployment benefits for 36 weeks after he found a job. He fraudulently obtained more than $12,000 in benefits, but served no jail time.

Wegmann got a new job, but it paid less than he was used to. So, to bridge the gap, he lied and told the state he was still unemployed. And he did so week, after week, after week -- for 36 weeks in a row.

Voice of Bryan Polcyn / FOX6 Investigators: "Don't you have to respond each week whether you have employment or not?"

Voice of David Wegmann / Fraud convict: "Yes, and that's where I made my mistake."

Wegmann now lives in suburban Chicago. In a phone call with the FOX6 Investigators, he said the whole thing was an act of desperation.

"I was just trying to survive at the time," Wegmann said.

In all, he racked up more than $12,000 in benefits he didn't deserve.

"That's taking money out of my pocket and employees' pockets," Weinrich said.

But Wegmann is far from alone.

A state audit released in December found that over a three-year period, more than $86 million in unemployment benefits were paid to people who intentionally misled the government about their eligibility.

The State Department of Workforce Development calls them overpayments. State Representative Samantha Kerkman (R-Salem) calls it fraud.

Representative Samantha Kerkman is working on legislative issues surrounding unemployment fraud.

"It's frustrating to me as a legislator that this many people are taking advantage of the system," Kerkman said.

In Madison, Kerkman co-chairs the Legislative Audit Committee. Last year, she requested an audit of the unemployment insurance program to find out why so many phone calls were being dropped during peak periods. But Kerkman says the audit uncovered something far more troubling -- nearly 65,000 fraudulent claims in just three years. Bogus claims made by 44,000 different people. That's enough unemployment cheats to fill every seat at Miller Park, and then some.

"It says that it's easy to do and we need to change the program," Kerkman said.

A FOX6 investigation finds the problem may be even worse than it sounds. Of the 44,488 unemployment cheats from July of 2011 through July of 2014, the state referred just 93 of them for criminal prosecution. In other words, 99.8% of the people who made intentional misrepresentations were not charged with a crime.

"I would like them to prosecute more if it so warrants," Kerkman said.

The State Department of Workforce Development declined requests for an on camera interview. In an email to the FOX6 Investigators, a department spokesman writes that prosecutions can take "years to resolve," so instead they focus on the "other methods" that they know are "effective at recovering fraudulent payments."

In 2013, the state recovered $23.9 million in fraudulent benefits through things like income tax intercepts and a reduction in future benefits. But state auditors say that's money that was paid out over the past 26 years, meaning there are tens-of-millions of dollars, if not hundreds-of-millions of dollars left to recover.

"I think if you make a statement, maybe you won't have so much fraud," Weinrich suggests.

Case in point -- Lolita Lee. In 2010, she was a nurse at Milwaukee's VA Hospital, making nearly $70,000 a year. Still, she was cashing weekly benefit checks of $388 for so long that by the time the state caught on, she'd amassed more than $40,000 in fraud.

"I mean, that's crazy," Kerkman said.

Lolita Lee stole more than $40,000 from the unemployment insurance fund while working as a nurse at Milwaukee's Zablocki VA Medical Center from 2009 through 2011.

Lee was convicted of an unclassified misdemeanor -- the lowest level crime possible. She was placed on probation with the agreement that she pay restitution of more than $50,000 in weekly installments of $12.50. At that rate, she'd have the balance paid off by the year 2089, when she would be 123 years old.

"It's really pennies. It's gonna take her a long time -- if she'll ever pay it back," Kerkman said.

Maybe she can't afford anymore than that. Or maybe she can. Lee now works at the VA Hospital in Minneapolis, Minnesota. Last summer, she moved into a luxurious, 3,600 square foot townhouse in Apple Valley. It rents for $2,395 per month.

The FOX6 Investigators went all the way to Minnesota to ask her how she's paying for it, but neighbors say she moved out a week before we got there.

"She should maybe visit a jail cell and see how much smaller they are," Weinrich said.

It seems actual jail time is reserved for only the most elaborate and extreme cases, like that of 52-year-old Calvin Sanders, who conspired with four other people to set up fake businesses with fake employees using stolen identities.

It worked long enough for Sanders and his co-conspirators to bilk $357,000 from the unemployment reserve fund.

For all his hard work, Sanders is now on a six-year vacation in federal prison.

"I think it'd be easier just to get a job," Weinrich said.

And that's the great irony. Most of the people cheating the unemployment system do have jobs.

"Then they're not in dire straits. They're just stealing," Weinrich said.

Lee was recently living in this 3,600 square foot townhouse in Apple Valley, Minnesota. It rents for $2,395 per month.

Or, as the Department of Workforce Development would say -- they're being overpaid. And the rest of us are paying the price.

In a second email to FOX6, John Dipko, spokesman for the Department of Workforce Development (DWD),writes that Lolita Lee's case is "outrageous" and exemplifies why DWD leaders have worked the past four years to strengthen fraud prevention, detection, recovery and deterrent efforts. He says Lee's case pre-dated the Walker Administration.

Dipko also points out that Governor Walker's 2015-2017 budget includes proposals to get tougher on unemployment fraud, including a measure than would make it a felony if the fraud amount exceeds $2,500.

State Representative Kerkman says she wants to see more cases prosecuted, and she's also working on legislation that would kick repeat offenders out of the unemployment system for at least seven years. She calls it a "two strikes and you're out" concept.

That bill is not yet ready for introduction, but it is likely to be a topic of discussion when the Legislative Audit Committee holds a hearing on this issue, which could happen next month.