West Allis property assessments rise; what to know about property taxes

WEST ALLIS, Wis. - Your new home assessment might have dropped your jaw. But after the sticker shock wears off, will your taxes go up? Just because your home's value has gone up, doesn't mean your taxes will.

Some homeowners are seeing a 70% increase in West Allis.

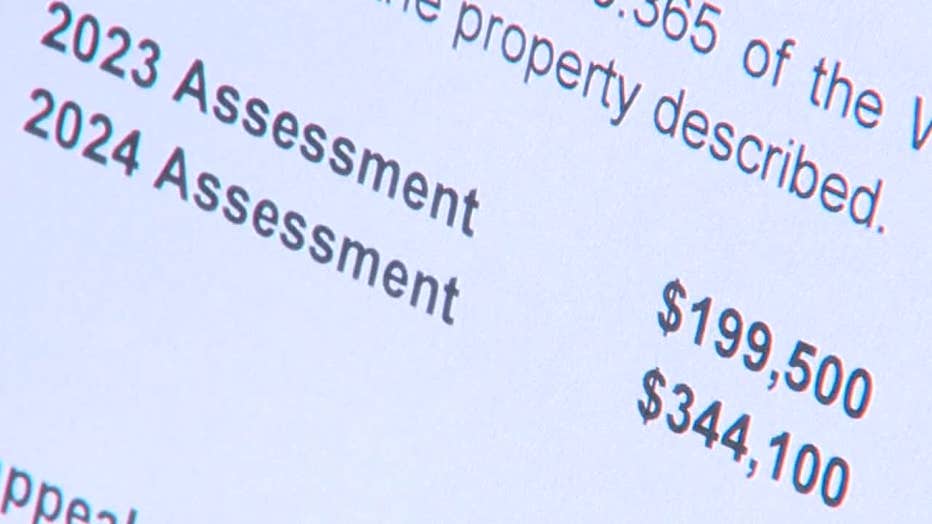

Dan and Sue Donahue bought their West Allis home in 1985 for $83,000. Since 2013, the city's assessed value of it hadn't changed; it's been roughly $200,000 every year for a decade.

"I’m shocked when they say it’s only worth $200,000. That’s why I’m saying, "Are you guys nuts?’" said Dan Donahue. "At $200,000? Which half of the house do you want to buy?"

For a decade, West Allis hasn't done what's called a revaluation on homes, meaning the assessed values were static. However, in recent years, home prices have surged. The city assessor blamed lack of staffing, the pandemic and budget restraints for the delays.

This year, the city reevaluated all the homes. State law requires it be based on the fair market value.

"If you’ve been watching the real estate market, if you’ve tried to sell a house, try to buy a house, try to rent an apartment, you know the price of houses have gone up steadily and quite a bit in recent years," said Jason Williams, West Allis city assessor. "Rent has gone up. We’ve also seen the value of industrial properties go up, and we’ve seen the value of office go down."

For the Donahues, their new assessment is 70% higher. The city assessed their home at $344,000.

"Some realtors come in. The house is probably worth $400,000 to $425,000, so compared to $344,000, we’re still $80,000 under, I think, retail value."

Another family saw a $130,000 increase in their assessment, a nearly 70% increase.

"We’re already struggling. We're both retired recently and everything’s up," said a West Allis homeowner. "The prices of real estate have gone crazy. But, our assessed value was so far below."

Another West Allis home recently sold for $405,000. From 2013 to 2023, the assessed value, like other homes in the city, was static. It was valued at $230,000. Finally, this year, the city assessed it nearly the same as the sale price.

Despite the spike in assessed values, that doesn’t necessarily mean their taxes will go up.

"Really, whether your property tax bill increases is far more dependent on two additional factors. First is to what extent did the increase in the assessed value of your home compare to the increase in assessed values to all other homes, as well as industrial and manufacturing properties within your municipality," said Rob Henken, Wisconsin Policy Forum president.

The second factor determining if your taxes will go up is the tax rates set by local governments in the fall.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android.

State law caps the levy, the total property tax local government can bring in from all properties combined. It can increase the levy based on the value of net new construction, that is new developments; but it cannot increase it because values for existing homes have increased. If the local government wants to go above the cap, it would have to go to referendum.

"You as a homeowner should be most worried, if at the end of the day, your value increased at a far greater proportion than other property values within your jurisdiction," Henken said. "Even if your elected leaders increase the levy by that 2 or 3 percent, to whatever’s allowed under state law, your property tax bill could go down. So really, the key question is what does your property value look like when compared to your neighbors in terms of the increase or decrease or staying the same of your valuation that year."

Will your tax go up or down? You won't know the answer until the end of the year. The city, county, school district, sewerage district and technical college set their budgets and tax rates in the fall. You won't receive your new property tax bill until December.

It’s not just West Allis with sticker shock; Milwaukee’s home assessment values, on average, are up 19%. This is Milwaukee's first revaluation in two years, and comes after home values have climbed.

"When the value of your home goes up, that’s not necessarily a bad thing. That means that it is more valuable and ultimately, when you are ready to sell your home, you will make more money on it," said Henken.

For those who disagree with their assessed value, there is still time to challenge the new assessments. Contact your municipal assessor for more information on deadlines.