Wisconsin property taxes; why you may be paying more than needed

Wisconsin property taxes; why you may be paying more

Milwaukee has missed the state's number for commercial properties and that could affect what you pay in property taxes.

WISCONSIN - There's a chance you paid more than you needed to in property taxes.

Your city, town or village assesses your property.

What we know:

The state comes up with its own total estimates, including commercial properties.

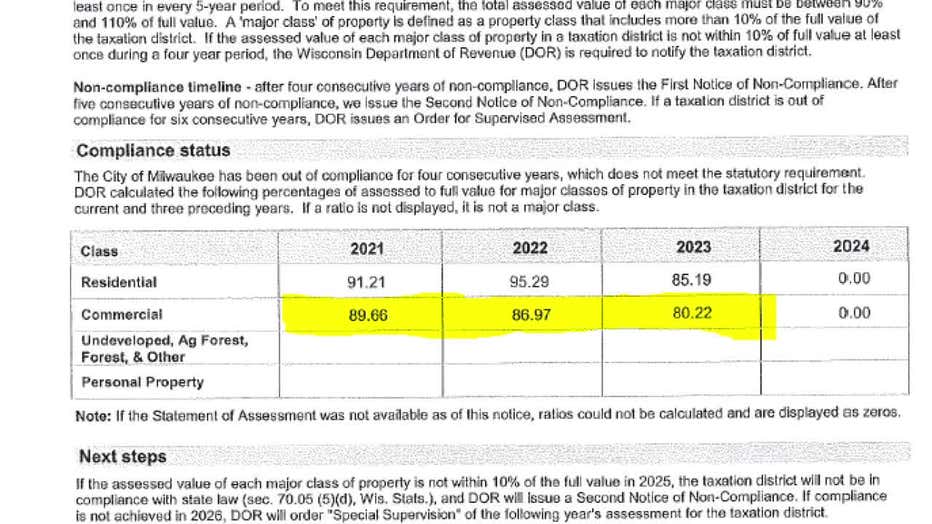

For four years in a row, Milwaukee has missed the state's number for commercial properties and that could affect what you pay. The Wisconsin Department of Revenue (DOR) is warning the city it’s not compliant.

State law says each municipality needs to be within 10% under or 10% over the state assessments. But for four years, Milwaukee's commercial assessments have fallen short.

SIGN UP TODAY: Get daily headlines, breaking news emails from FOX6 News

But why?

Commercial property values were expected to take a major hit during the COVID-19 pandemic.

Pandemic assessments

What they're saying:

"I would suggest that statewide, for sure, and nationally, most assessors believed that the pandemic was going to cause values to drop, we saw commercial properties, downtown buildings emptying out, we saw the hotels emptying out, values going down, you couldn’t have gatherings of more than 50 people downtown down to five people, so all your commercial retail, your local merch, all of that business was giving indicators of being a major downturn, possibly a recession," said Milwaukee chief assessor Bill Bowers.

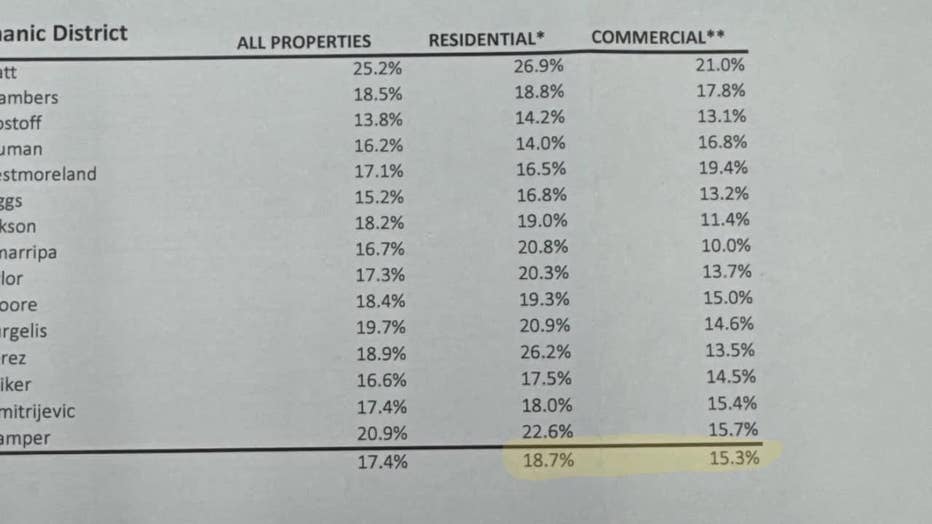

Documents from the city reveal residential assessments went up last year 18.7% while commercial went up at a smaller rate at 15.3%

"That segment of real estate has had some real struggles since COVID, and it hasn’t bounced back as quickly as residential properties have," Alderman Peter Burgelis said. "As the market changes, the assessor's office will also reflect those changes. The increase in market values for properties to a lot of people was shocking, but the real estate market really has increased substantially over the last couple of years and our assessments have caught up to a more accurate, true market value."

The state finds Milwaukee residential properties were in compliance with the state, but still undervalued, getting to 95% of the state number in 2022 and 85% in 2023. But commercial didn't hit the needed 90% in 2023; it was 80%.

This doesn't mean the city's lost money, but it does typically mean residential property owners help make up the difference, paying potentially more than you needed to.

The backstory:

"The share of the levy shifts elsewhere," Bowers said. "And so we started to look at our statistics and that was shifting to the residential more so than it ought to have been."

The city assesses commercial properties differently than the state. The state analyzes sales, while the city says there's not always sales records or comparable sales to look at. So it'll look at how much income the building is bringing in.

"We do an income approach to determine values on commercial properties, so they were telling us: we’ve lost income, we have excessive vacancy, you have to recognize the vacancies, you have to recognize that our income has gone," Bowers said.

The state of Wisconsin finds problems with 2024 assessments in 11 of 19 Milwaukee County municipalities:

Greendale, River Hills, Shorewood, West Milwaukee, Whitefish Bay, Franklin, Milwaukee, St. Francis, South Milwaukee, Wauwatosa and West Allis.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android

More than half of Waukesha County's 40 municipalities are undervaluing some properties, either commercial, residential or both. But they have four years to get it right.

"There are more communities now more than ever that are receiving these notifications, to notify them, to put them on alert," Wisconsin DOR supervisor Charles Paskey said.

Milwaukee's assessor staff say they're confident they'll be in compliance this year.

How it's looking

By the numbers:

If the city doesn't reach the state benchmark, then the state will send a second notice of non-compliance.

West Allis got one of those warnings this year for undervaluing commercial properties. West Milwaukee also received a second notice of non-compliance.

Right now, Milwaukee says they expect to be in compliance this year.

Eleven municipalities in Milwaukee missed the state benchmark this year, but they only need to hit it once every five years.

So no, property owners, you're not getting your money back.

The Source: