Shared revenue bill signed, Milwaukee sales tax hike possible

Wisconsin shared revenue; what Milwaukee could do next

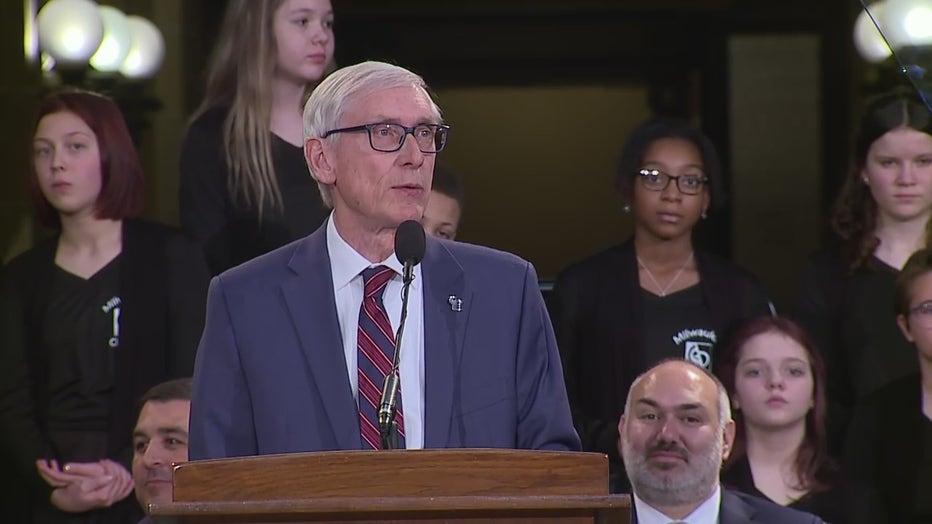

Wisconsin Gov. Tony Evers signed a bipartisan shared revenue bill Tuesday that sends more money to Milwaukee in an effort to avoid bankruptcy.

MILWAUKEE - Wisconsin Gov. Tony Evers signed a bipartisan bill Tuesday, June 20 that sends more shared revenue back to local governments and could help Milwaukee avoid a fiscal cliff, but some Milwaukee Common Council members threatened to sue some provisions in the new law that restrict the city.

The bill also gives Milwaukee the ability to raise the local sales tax, something Milwaukee leaders said was needed to avoid a fiscal crisis.

"This shared revenue package for us means absolutely everything. It is our city’s opportunity to start over," said State Sen. LaTonya Johnson (D-Milwaukee) at the governor's singing ceremony in Wausau, Wis.

With that new law, the Milwaukee County Board of Supervisors now has the power to add 0.4% to its current sales tax of 0.5%. The Milwaukee Common Council can create a new city sales tax of 2%. It means sales tax in Milwaukee could go from 5.5% currently to 7.9%

"Now, the ball is in our court," said Ald. Marina Dimitrijevic.

The Common Council President Jose Perez said the body will vote on the sales tax proposal on July 11. If 10 of the 15 members approve, the new sales tax will apply across the city. It is unclear if there are enough votes right now to approve it.

"I’d rather not state whether I’m voting yes or no at this time," said Ald. Laressa Taylor. "Because we’re still making decisions right now."

"I’m not ready to reveal my position yet. I’m trying to weigh all options," said Ald. Russell Stamper.

The nonpartisan Legislative Fiscal Bureau estimates the proposed city sales tax would bring Milwaukee $194 million per year. Milwaukee's leaders, including Mayor Johnson, as well as the Wisconsin Policy Forum, said without extra income, the city would face a fiscal crisis in 2025, and be forced to make devastating cuts.

"For the city of Milwaukee, we were on the verge of insolvency and for us that meant we would have had to lay off 700 police officers, 250 firefighters, we would have basically lay off 17 engines," said Sen. LaTonya Johnson.

One of the looming problems is the ballooning pension program. The law requires the city use the sales tax income to fill the pension holes. Any leftover money would have to go to hiring more police officers and firefighters.

FREE DOWNLOAD: Get breaking news alerts in the FOX6 News app for iOS or Android.

"The city of Milwaukee will not survive a $200 million cut," said Ald. Jonathan Brostoff. "If I have the chance to save my city, I’m going to save my city."

The state law places special requirements on the city; Common Council President Jose Perez said his chamber will vote on ways to counter those restrictions.

The law will require Milwaukee Public Schools bring back police officers to school, hiring at least 25 school resources officers. The law restricts what is known as DEI (diversity, equity and inclusions) by stopping the city from using tax money on jobs that have the principal duty of "promoting individuals or groups on the basis of their race, color, ancestry, national origin or sexual orientation." The law also states no tax money can go toward the Hop streetcar. The law also requires the city commission an independent audit of the Office of Violence Prevention. Furthermore, the city is to determine what unused buildings the city has the authority to sell.

One proposal is for the Common Council to approve hiring outside lawyers to sue the state.

"To challenge various provisions of the bill in court that we thought were too far and overreaching and quite frankly unjust and unfair," said Dimitrijevic.

Milwaukee City Hall

Republicans criticized the proposal to sue. "After a historic opportunity for the city of Milwaukee to reset their finances, it seems like they should turn their attention to actually doing that instead of focusing on frivolous lawsuits," wrote Assembly Speaker Robin Vos (R-Burlington) in a statement.

The Common Council will vote on other ways to counter the restrictions. To get around the prohibition of using tax money on diversity initiatives, the Common Council will vote on whether to tap into some of the city's unused share of federal American Rescue Act money to double funding to the Office of Equity and Inclusion, as well as the Office of African American Affairs.

"Our understanding is we’re prevented from using city taxpayer levy funded monies. What I want you to know is we are committed as a Common Council in a very unified voice, doing everything we can to promote diversity, equity and inclusion," Dimitrijevic said about instead using federal money to fund that work.

As for ban on using city tax money for the streetcar, the Common Council will vote to call on the city to seek federal grants to fund the extension.

"Nothing is dead at this point," Dimitrijevic added regarding the Hop. "We have been dealt a lot of unique challenges in the city of Milwaukee, like no other city was in this bill."

Wisconsin Gov. Tony Evers

People in Milwaukee will have the chance to share their thoughts with the Common Council; a public hearing is scheduled for Monday, June 26. Then on July 11, Perez said the Common Council will vote on both the sales tax and proposals challenging parts of the shared revenue law.

What else the bill does

The measure also sends 36% more money overall to every other smaller city, town, village and county in Wisconsin, part of a deal Evers struck with Republican legislative leaders to also increase funding for K-12 public schools and spend more money on private school vouchers.

Evers signed the bill surrounded by a bipartisan group of state lawmakers, Milwaukee leaders and local officials in Wausau. Local governments have been clamoring for more state aid following years of cuts or stagnant funding that have forced cuts to essential services like police and fire protection.

"For far too long, our local communities have been forced to do more with less," Evers said. "And we’ve seen the consequence of that play out in communities across Wisconsin."

He said communities have been "forced to make impossible decisions about what essential services to fund."

The roughly $1 billion in aid to local governments – known as shared revenue – would be paid for by tapping 20% of the state’s 5-cent sales tax. Aid would then grow along with sales tax revenue. The measure increases current aid by about $250 million statewide.

Some Republicans in the Legislature had wanted to require a vote of the people before those local sales taxes could be raised. But Milwaukee leaders, Democrats and some Republicans argued the need for more funding was too critical to leave to a referendum vote that could fail.

Wisconsin Capitol, Madison

The shared revenue program to fund local governments, created in 1911, has remained nearly unchanged for almost 30 years, despite overall growth in tax revenues. Shared revenue for counties and municipalities was cut in 2004, 2010 and 2012 and since then has been relatively flat.

The Legislature passed the bill on a bipartisan vote last week. While the focus of the new law is sending more money to Wisconsin's local governments, it also includes a wide array of other provisions.

Those include cutting aid to communities that reduce the number of police officers and firefighters and banning public health officials from ordering businesses closed for more than 30 days without approval from a local governing board, which could extend closures for only an additional 30 days.

The law also forbids local communities from putting advisory referenda questions on the ballot, except those related to certain projects that would be funded with property tax money. The bill would not allow questions on hot-button issues like whether voters support abortion rights, accept Medicaid expansion or legalize marijuana, which many communities across the state have put forward in recent years.

The law also targets diversity, equity and inclusion efforts. It also says that no local government "may discriminate against, or grant preferential treatment on the basis of, race, color, ancestry, national origin, or sexual orientation in making employment decisions."

Evers also signed a second bill increasing funding for schools, which some Democrats objected to because it also increases funding for vouchers, which pay for students to attend private schools. Evers, a former state education secretary, heralded the additional $1 billion in money for K-12 schools, including more for special education, literacy programming and mental health services.

The Associated Press contributed to this report.