Good news for anyone with a student loan? That's not exactly clear

MILWAUKEE - This may be good news for anyone with a student loan. The president said he wants to pause payments through the end of the year. But the details to this plan are not exactly clear.

"Without these loans, I wouldn't have this great education that I have," said Erica Blohm, a graduate of the University of Wisconsin-Madison.

Erica Blohm

Blohm now works with the local alumni chapter to lessen the burden of college debt on others.

"We do a lot of events during normal times to raise funds for scholarships," Blohm said.

As for her own college loans, Blohm is not bitter.

"It really was the reason I could go to college, I didn't have the money saved up," Blohm said.

Erica Blohm

But since March, alumni like Blohm have had the option of paying their student loans or not. The CARES Act temporarily suspends federal student loan payments -- and sent interest rates at zero percent through Sept. 30.

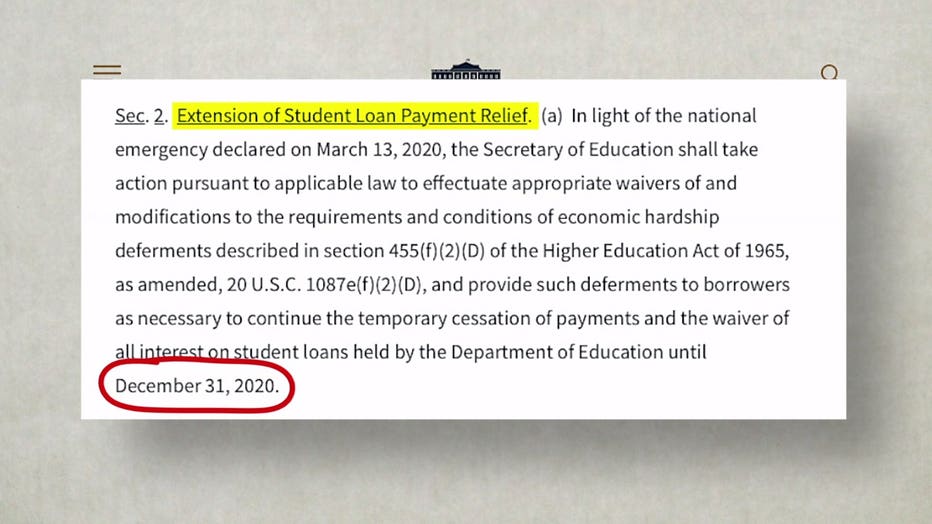

In a recent memorandum, President Donald Trump ordered an extension of loan forbearance through Dec. 31.

"Having one less stressor during this time I think is huge," Blohm said.

The postponing of student loans impacts millions of people -- including at Marquette University, where the average debt for undergraduates leaving the school is about $35,000.

"All of the details surrounding the president's executive order aren't completely understood at this time," said Susan Teerink, Associate Vice Provost for Financial Aid and Enrollment Services.

Marquette University

Teerink said it is not clear yet if the executive order completely mirrors the CARES Act -- which automatically places anyone with a federal direct student loan into postponement status. Financial aid administrators do not know if that would still be the case.

"They aren't clear whether the students actually have to opt in," Terrink said.

Susan Teerink

Some loans are not eligible for forbearance, like FFEL program and HEAL loans owned by commercial lenders, or Perkins loans owned by institutions.

Financial planner Warwees Holt said anyone with money troubles can use a loan as an opportunity.

"I always suggest an emergency savings. So, just put a little bit of that, and start your emergency savings," Holt said.

Warwees Holt

Blohm has seized her own opportunity to make zero-interest payments.

"I've been very fortunate during the pandemic to be able to continue paying off these student loans," Blohm said.

Financial aid administrators are waiting for the White House and Department of Education to clarify the president's order. It is important to make clear -- neither the CARES Act nor the order offers student loan forgiveness, just postponement.